The $1.5 Trillion Question: Is AI Investment a Bubble or the Future?

The world is witnessing an investment phenomenon unlike anything since the dot-com boom. In 2024 alone, artificial intelligence companies attracted over $100 billion in venture capital funding, while semiconductor manufacturing has seen commitments exceeding $630 billion. Tech giants are pouring unprecedented sums into AI infrastructure, with some analysts now questioning whether this represents visionary transformation or dangerous overinvestment. The answer may determine the trajectory of the global economy for the next decade.

The Numbers Don’t Lie: A Historic Investment Surge

AI Funding Reaches Stratospheric Heights

The scale of AI investment in 2024-2025 defies historical precedent:

- Global AI VC funding in 2024: $110 billion (up 80% from $55.6 billion in 2023)

- Generative AI funding alone: $45 billion (nearly double 2023’s $24 billion)

- 2025 trajectory: Through August, AI startups raised $118 billion, on pace to exceed 2024’s record

- Market concentration: AI captured 33% of all global venture funding in 2024

To put this in perspective, AI investment in 2024 represented the highest funding year for the sector in the past decade, surpassing even the peak global funding levels of 2021. The late-stage deal sizes tell an even more dramatic story: average valuations jumped from $48 million in 2023 to $327 million in 2024 for generative AI companies.

The Mega-Deals Reshaping the Landscape

Several landmark investments have captured headlines and capital:

OpenAI’s Meteoric Rise

- October 2024: $6.6 billion at $157 billion valuation

- March 2025: $40 billion round pushing valuation to $300 billion

- August 2025: Additional $8.3 billion (5x oversubscribed)

- Microsoft’s total investment: $14 billion for 49% profit share

- Current status: Most valuable private company globally at $500 billion valuation

Other Notable Rounds

- Databricks: $10 billion at $62 billion valuation (largest VC raise of 2024)

- Anthropic: Discussions for $2 billion at $60 billion valuation

- Perplexity AI: $500 million at $9 billion valuation

- Safe Superintelligence: $1 billion funding round

- Scale AI: $1 billion raise

The Semiconductor Infrastructure Boom

Parallel to AI software investments, chip manufacturing is experiencing its own renaissance driven by the CHIPS and Science Act and global competition:

U.S. Government Investment

- Total CHIPS Act funding: $52.7 billion over five years

- Manufacturing incentives: $39 billion

- R&D programs: $11 billion

- Awards announced: $33.7 billion in grants, $28.8 billion in loans to 32 projects across 20 states

Major Awards Include:

- Intel: $7.86 billion (supporting $100 billion investment plan)

- TSMC: Billions for Arizona fabrication facilities

- Micron: Major funding for New York operations

- Samsung: Substantial incentives for Texas operations

- Hemlock Semiconductor: $325 million for polysilicon production

Private Sector Response

Companies have announced over $630 billion in semiconductor supply chain investments since the CHIPS Act passed, spanning 130+ projects across 28 states. This represents one of the largest industrial mobilizations in U.S. history.

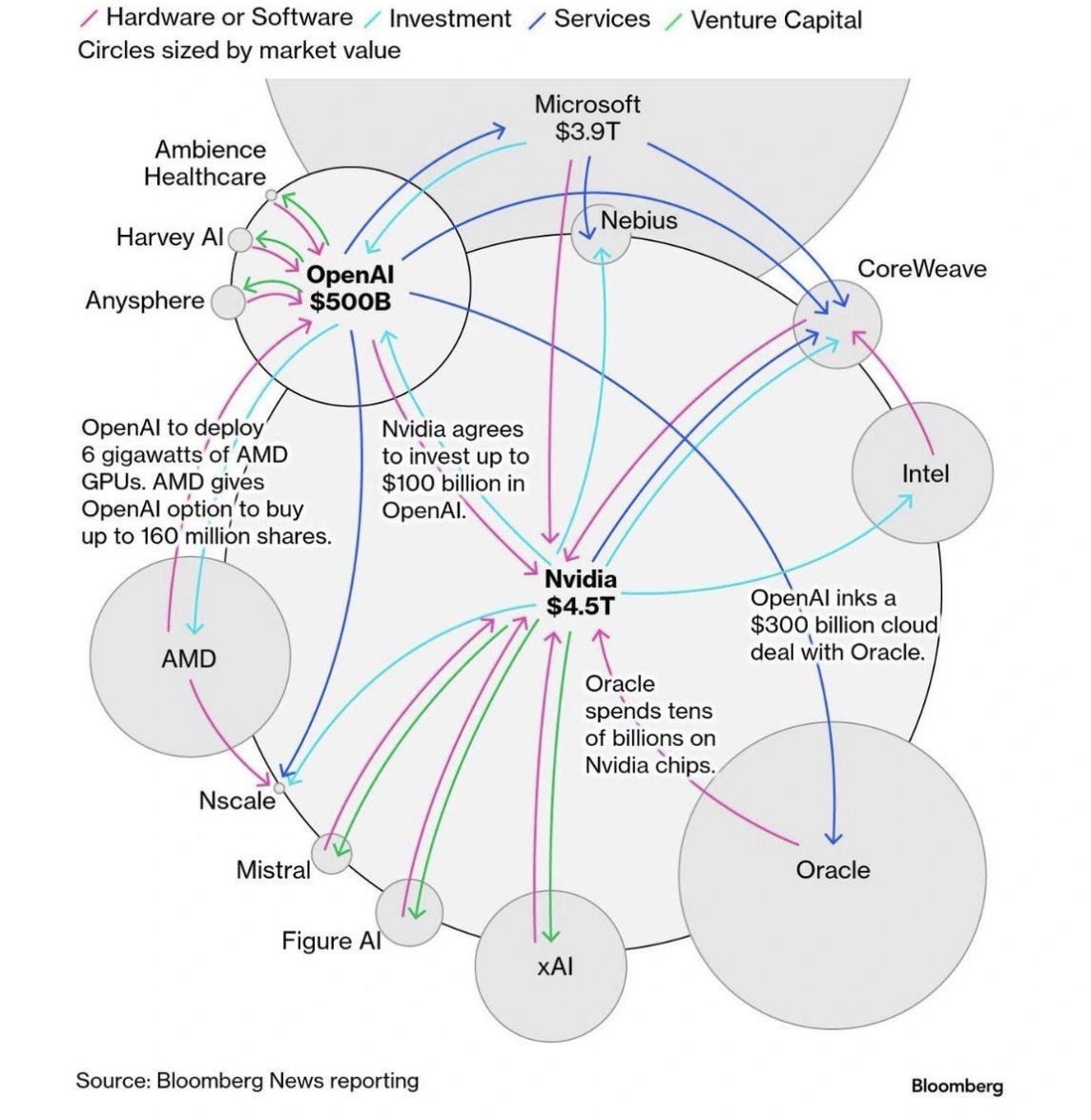

The Cross-Investment Web: A New Financial Ecosystem

Perhaps the most striking feature of the current AI boom is the intricate web of cross-investments among major players, creating what some call “circular funding.”

The Magnificent Seven’s AI Arms Race

The tech giants—Microsoft, Amazon, Google (Alphabet), Meta, Apple, Nvidia, and Tesla—are engaged in an unprecedented capital expenditure competition:

2025 Capex Commitments:

- Amazon: $105 billion (including $26 billion in Q4 2024 alone)

- Microsoft: $80 billion for fiscal 2025

- Alphabet/Google: $75 billion (up 43% year-over-year)

- Meta: $64-72 billion (raised multiple times through 2025)

- Oracle: Aggressive data center expansion for AI infrastructure

These five companies alone account for over $400 billion in AI-related capital expenditures, representing the largest concentration of capital deployment in tech history.

The Circular Investment Phenomenon

The investment relationships create a complex, interconnected network:

Nvidia’s Strategic Position:

- Investing $100 billion in OpenAI

- Holds equity stakes in CoreWeave (AI cloud computing)

- Completed 50+ venture capital deals in 2024

- Invests in startups that then purchase its chips

Microsoft’s Multi-Layered Approach:

- $14 billion total investment in OpenAI

- Major customer of CoreWeave (20% of Nvidia’s revenue comes from Microsoft)

- Provides Azure cloud exclusively to OpenAI

- Recent $17.4 billion deal with Nebius for AI infrastructure

OpenAI’s Ecosystem:

- Taking 10% stake in AMD

- Microsoft as major shareholder and exclusive cloud provider

- Partnership with Oracle and SoftBank on $500 billion Stargate Project

- Investment from Nvidia, SoftBank, Thrive Capital, Fidelity, Sequoia

The Network Effects: This creates a self-reinforcing loop: tech giants invest in AI startups → startups use funds to buy chips from Nvidia/AMD → chip makers invest in the same AI companies → those companies rent computing power from Microsoft/Amazon/Google → who then invest more in AI infrastructure.

The Economic Impact: AI as GDP’s New Engine

AI’s Outsized Contribution to Growth

The economic data reveals AI’s dramatic influence on GDP:

Q1-Q2 2025 Statistics:

- AI-related investment contributed 31% of U.S. GDP growth (up from typical 9-14%)

- Investment in information processing equipment & software: only 4% of GDP but responsible for 92% of GDP growth in H1 2025

- Without AI spending, U.S. economy would have grown at just 0.1% annually

- AI capex surpassed consumer spending as primary GDP growth driver (1.1% of total growth)

Historical Context: Harvard economist Jason Furman noted that excluding data center construction and tech infrastructure, the U.S. would have been close to recession in 2025. Deutsche Bank analysis similarly concluded that without AI investment, the economy might already be in recession.

The Productivity Promise vs. Reality

Long-term Projections:

- Goldman Sachs estimates AI could increase U.S. productivity growth by 1.5 percentage points annually over 10 years

- Penn Wharton Budget Model projects AI’s TFP contribution at 0.01 percentage points in 2025, rising to 0.19 by 2032

- Potential worldwide GDP boost: up to 15% if productivity gains fully materialize

- Expected measurable GDP impact: starting 2027 for U.S., 2028 for other economies

Current Reality:

- Job growth in high-AI-exposure occupations has stagnated

- Employment in jobs that can be fully automated by AI fell 0.75% from 2021-2024

- Manufacturing sector in recession for 2+ years

- Services sector ISM PMI fell to 50 in September 2025 (indicating stagnation)

Red Flags or Growing Pains? The Bubble Debate

Warning Signs From Market Leaders

In a remarkable departure from typical executive optimism, several industry titans have publicly voiced concerns:

Direct Warnings:

- Goldman Sachs CEO David Solomon: “There will be a lot of capital that was deployed that doesn’t deliver returns”

- Jeff Bezos: Called the current environment “kind of an industrial bubble”

- Sam Altman (OpenAI CEO): “People will overinvest and lose money during this phase”

- Mark Zuckerberg: Acknowledged “an AI bubble is quite possible”

Yale CEO Survey: At a June 2025 summit of 150+ CEOs, 40% raised significant concerns about AI overinvestment and believed a correction was imminent.

Institutional Warnings Escalate

October 2025 Financial Institution Alerts:

- Bank of England: “The risk of a sharp market correction has increased”

- IMF Managing Director: Warned financial conditions could “turn abruptly” despite market optimism

- Both institutions flagged tech stock prices as potentially overinflated by AI enthusiasm

Comparative Bubble Metrics

The current AI investment wave shows concerning similarities to past bubbles:

Market Concentration:

- AI-related stocks: 75% of S&P 500 returns since ChatGPT’s launch

- 80% of earnings growth concentrated in AI companies

- 90% of capital spending growth from AI-related firms

- Tech sector’s market cap-to-earnings gap widest since late 2022

Valuation Concerns:

- AI investment “bubble” measured at 17x the size of dot-com frenzy (2000)

- 4x larger than subprime mortgage bubble (2007)

- Buffett Indicator (stock market value to GDP): 217% (new record, 2+ standard deviations above trend)

- PitchBook data: Nearly two-thirds of U.S. deal value went to AI/ML startups in H1 2025 (up from 23% in 2023)

Key Differences from Dot-Com Era

Fundamental Strengths:

Revenue Generation: Unlike dot-com companies with minimal revenue, today’s AI leaders generate substantial cash flow

- OpenAI: $12.7 billion projected revenue in 2025 (up from $3.7 billion in 2024)

- 700 million weekly ChatGPT users

- 20 million paid subscribers by April 2025

Profitable Base Companies: The Magnificent Seven aren’t startups—they’re established, profitable giants

- Meta Q3 2024: $40.6 billion revenue, $15.7 billion profit (up 35% YoY)

- Amazon, Microsoft, Google all generating massive positive cash flows

- Nvidia: Dominant market position with actual product demand

Real Infrastructure: Unlike purely digital dot-com assets, AI requires physical infrastructure with tangible value

- Data centers

- Semiconductor fabs

- Power infrastructure

- Even if AI underperforms, assets remain valuable

Concerning Similarities:

- Valuation Disconnect: Market values increasingly divorced from near-term profitability

- Herd Mentality: Fear of missing out driving investment decisions

- Revenue Concentration: Success relies on small number of use cases

- Long Payback Periods: OpenAI not expected cash-flow positive until 2029; projects $115 billion cash burn through 2029

The Cross-Funding Mechanism: How Money Circulates

The Value Creation Chain

Understanding how investments translate to revenue requires mapping the ecosystem:

Stage 1: Capital Injection

- VCs and tech giants invest billions in AI startups

- Example: OpenAI receives $14 billion from Microsoft

Stage 2: Infrastructure Purchases

- AI companies spend on computing infrastructure

- OpenAI/Meta/Google purchase Nvidia GPUs ($40,000+ each)

- Nvidia’s revenue surges (serving as indirect return to Microsoft)

Stage 3: Cloud Services

- Companies rent cloud computing power

- Microsoft Azure hosts OpenAI exclusively

- Amazon AWS, Google Cloud compete for enterprise AI workloads

Stage 4: Software Monetization

- AI capabilities integrated into products

- Microsoft Copilot subscriptions

- ChatGPT Plus subscriptions ($20/month)

- Enterprise API access fees

Stage 5: Productivity Gains

- End users theoretically gain efficiency

- Cost savings from automation

- New product capabilities

- Revenue growth from AI-enhanced services

The Sustainability Question

Arguments for Sustainability:

- Network Effects Lock-In: First movers establishing dominant market positions

- Infrastructure Moats: Billions in sunk costs create barriers to entry

- Actual User Adoption: ChatGPT’s 700 million weekly users demonstrate real demand

- Enterprise Integration: Companies embedding AI into core workflows

- Scientific Progress: Real breakthroughs in protein folding, drug discovery, materials science

Arguments Against:

Revenue-Investment Gap: Current revenues don’t justify investment levels

- OpenAI $13B projected 2025 revenue vs. $58B total funding raised

- Projected $115B cash burn through 2029

Commoditization Risk: Open-source models (Meta’s Llama, Mistral) threaten pricing power

Uncertain ROI Timeline: Productivity gains may take decades to materialize fully

Energy Constraints: Data center power demands strain grid capacity

Regulatory Risk: Governments may restrict AI development or data usage

Recession Suppression or Genuine Growth?

The Counterfactual: What Without AI?

Economic modeling suggests AI investment is masking underlying weakness:

2025 Economic Indicators Without AI:

- GDP growth: ~0.1% (near-recession levels)

- Manufacturing: Already in recession for 2+ years

- Services sector: Stagnating (ISM PMI at 50)

- Labor market: Employment growth at 0.5% annualized (weak)

- Trade deficit: Up 31% YoY to $654 billion in first 7 months

The Structure of Dependence: Investment in information processing equipment, while only 4% of GDP, drove 92% of growth in H1 2025. This creates dangerous concentration:

- If AI spending slows, GDP contracts sharply

- Traditional growth drivers (consumer spending, manufacturing, real estate) are stagnant

- Economy has become “one big bet on AI” (economist Ruchir Sharma)

The Policy Dimension

Monetary Policy Implications:

- Federal Reserve faces dilemma: AI spending supports growth but may be unsustainable

- Interest rates remain elevated, yet AI investment continues (unusually rate-insensitive)

- If bubble bursts, Fed has limited ammunition (rates still historically elevated)

Fiscal Policy:

- CHIPS Act represents industrial policy comeback

- $52.7 billion government investment leveraging $630 billion private sector response

- Creates jobs but doesn’t address underlying productivity challenges

The Tariff Complication:

- Trump administration tariffs haven’t reduced trade deficit as promised

- May increase costs for chip manufacturing (imported equipment, materials)

- Geopolitical tensions with China accelerating domestic investment urgency

International Dimensions: The Global AI Race

Capital Flows and Regional Disparities

Geographic Investment Distribution:

- United States: $80.7 billion (42% of global AI VC in 2024)

- Europe: $12.8 billion (25% of regional VC)

- China: $7.6 billion (2024 standout despite restrictions)

- Rest of World: 18% of global AI investment

Long-term Investment Trends (2013-2024):

- U.S. private AI investment: $470 billion (nearly 25% in 2024 alone)

- China: $119 billion total

- This disparity drives national security concerns and competition

The Semiconductor Supply Chain

Regional Buildout:

- U.S. aims to increase chip production capacity 203% by 2032

- Global market share target: 10% → 14% by 2032

- Taiwan remains dominant in leading-edge production

- Europe investing €43 billion in semiconductor independence

- China pursuing aggressive domestic production despite export controls

Foreign Investment in U.S.:

Record $290 billion flowed into U.S. stocks in Q2 2025, with foreigners now owning ~30% of market—highest post-WWII share. This capital inflow helps fund AI buildout but creates vulnerability if sentiment shifts.

Three Scenarios: Where Do We Go From Here?

Scenario 1: Soft Landing (40% Probability)

What Happens:

- AI gradually proves ROI over 5-10 years

- Revenue growth catches up to investment levels by 2027-2029

- Valuations compress but companies remain viable

- Infrastructure investment provides foundation for next generation of applications

- Productivity gains materialize gradually, boosting GDP 0.3-0.5% annually

Required Conditions:

- Breakthrough applications beyond chatbots

- Enterprise adoption accelerates

- Energy infrastructure scales to meet demand

- No major regulatory restrictions

- Geopolitical stability

Historical Parallel: Similar to internet’s arc—1998-2002 crash followed by 2003-2007 genuine growth as infrastructure found use cases

Scenario 2: Hard Crash (35% Probability)

What Happens:

- Revenue growth disappoints vs. expectations

- Major AI companies report losses/lower guidance

- Investors flee; valuations crash 50-80%

- Contagion spreads to broader tech sector

- U.S. GDP contracts 2-4% as AI investment evaporates

- Recession ensues, potentially severe

Triggering Events:

- OpenAI or similar company fails to convert users to paying customers at scale

- Breakthrough model from unexpected competitor commoditizes current leaders

- Energy costs make operations unsustainable

- Regulatory crackdown on data usage/AI applications

- Nvidia faces sudden demand cliff

Historical Parallel: Dot-com crash (2000-2002) saw NASDAQ fall 78%; many promising companies disappeared entirely

Scenario 3: Prolonged Plateau (25% Probability)

What Happens:

- AI capabilities stagnate at current level

- Neither crash nor breakthrough—muddling through

- Valuations gradually decline over 3-5 years

- Capital redirected to other sectors

- Moderate recession as growth engine disappears

- Infrastructure remains underutilized

Outcome:

- Similar to 3D printing, blockchain, or VR—promising technology that achieves niche success but not transformative impact anticipated

- Investors lose money but not catastrophically

- Real economic impact minimal

Investment Implications and Risk Management

For Individual Investors

Bull Case Positions:

- Direct AI Exposure: Nvidia, Microsoft, Amazon, Google (infrastructure providers with diversified business)

- Picks and Shovels: Semiconductor equipment (ASML), data center REITs, power infrastructure

- Defensive AI: Companies using AI to improve margins in traditional industries

Risk Mitigation:

- Avoid concentration >20% portfolio in AI-specific names

- Focus on profitable companies with strong balance sheets

- Set stop losses given volatility

- Consider hedging strategies if heavily exposed

Bear Case Positions:

- Short AI-only companies with no revenue

- Long value stocks in underinvested sectors (energy, materials, industrials ex-AI)

- Treasury bonds if expecting recession

For Policymakers

Recommendations:

- Monitor Systemic Risk: AI investment concentration creates fragility

- Maintain Flexible Monetary Policy: Prepare for potential sudden reversal

- Diversify Growth Strategies: Don’t rely solely on AI for economic expansion

- Invest in Complementary Infrastructure: Power grid, workforce training

- Balanced Regulation: Prevent harm without stifling innovation

Conclusion: Bubble, Vision, or Both?

After analyzing the data, the answer is nuanced: This is simultaneously a legitimate technological revolution AND a financial bubble.

The Case for Vision

Undeniable Realities:

- AI capabilities have advanced dramatically in 2-3 years

- Real user adoption (700M weekly ChatGPT users) demonstrates utility

- Infrastructure investment creates tangible assets

- Scientific breakthroughs (protein folding, drug discovery) validate transformative potential

- Leading companies are profitable giants, not dot-com fantasies

The Case for Bubble

Concerning Facts:

- Valuations disconnected from current profitability

- 92% of U.S. GDP growth dependent on single sector

- Revenue growth lagging investment by orders of magnitude

- Circular funding creating artificial demand

- CEO warnings from industry insiders

- Market metrics exceeding all previous bubble levels

The Synthesis

The most likely outcome is boom, bust, then genuine transformation—the classic Gartner Hype Cycle applied to capital markets.

Near-term (2025-2027): Continued exuberance and investment, with growing skepticism. Potential correction of 30-50% as reality disappoints initial expectations. Recession risk elevated if correction is severe.

Medium-term (2027-2030): Shakeout separates winners from losers. Surviving companies find sustainable business models. Infrastructure built during boom enables new applications. GDP impact becomes measurable as productivity gains materialize.

Long-term (2030+): AI becomes embedded infrastructure like electricity or internet. Transformative impact on productivity, healthcare, scientific discovery. Initial investors who survived volatility reap rewards.

The Final Verdict

Is this AI investment surge suppressing a U.S. recession? Yes, absolutely. Without the AI buildout, economic data suggests the U.S. would likely be in recession already. Manufacturing is contracting, services are stagnant, and consumer spending is weakening.

Does this make AI investment a Ponzi scheme? No. Real technology exists, real companies are building real products with real users. Unlike Ponzi schemes, value is being created—the question is whether it justifies the investment level.

Is there a bubble? Yes. Valuations are extreme, concentration is dangerous, and expectations are likely inflated. Some (perhaps many) current investments will lose money.

Should you be worried? It depends.

- If you’re diversified investor: Moderate exposure to AI winners makes sense; avoid overconcentration

- If you’re AI-company employee: Understand your company’s burn rate and path to profitability

- If you’re business leader: Adopt AI pragmatically; competitive pressure is real but so is implementation risk

- If you’re concerned citizen: AI investment is propping up economy but creating fragility; diversified growth strategies needed

The AI revolution is real. The bubble is real. Both can be true simultaneously. The trillions being invested will transform something—the question is whether it transforms society or just balance sheets.

The next 2-3 years will tell us which vision prevails.

Data compiled from Crunchbase, Dealroom, Goldman Sachs Research, Penn Wharton Budget Model, Bloomberg, Federal Reserve, Department of Commerce, and company financial filings. Analysis current as of October 19, 2025.