The world is witnessing an investment phenomenon unlike anything since the dot-com boom. In 2024 alone, artificial intelligence companies attracted over $100 billion in venture capital funding, while semiconductor manufacturing has seen commitments exceeding $630 billion. Tech giants are pouring unprecedented sums into AI infrastructure, with some analysts now questioning whether this represents visionary transformation or dangerous overinvestment. The answer may determine the trajectory of the global economy for the next decade.

The Numbers Don’t Lie: A Historic Investment Surge

AI Funding Reaches Stratospheric Heights

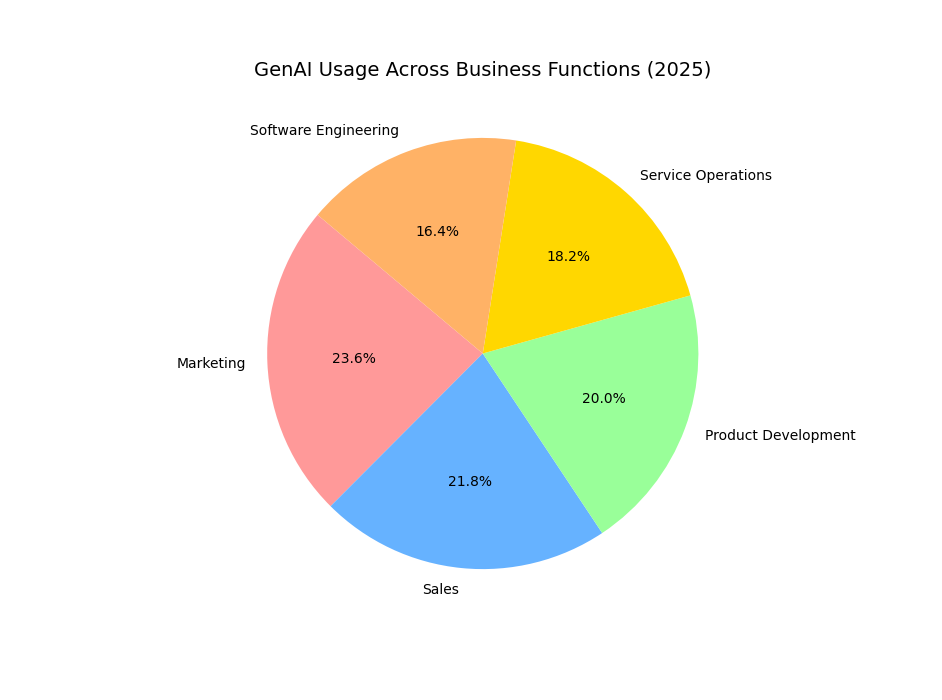

The scale of AI investment in 2024-2025 defies historical precedent:

- Global AI VC funding in 2024: $110 billion (up 80% from $55.6 billion in 2023)

- Generative AI funding alone: $45 billion (nearly double 2023’s $24 billion)

- 2025 trajectory: Through August, AI startups raised $118 billion, on pace to exceed 2024’s record

- Market concentration: AI captured 33% of all global venture funding in 2024

To put this in perspective, AI investment in 2024 represented the highest funding year for the sector in the past decade, surpassing even the peak global funding levels of 2021. The late-stage deal sizes tell an even more dramatic story: average valuations jumped from $48 million in 2023 to $327 million in 2024 for generative AI companies.

Read on → Source: Internet

Source: Internet Source: Generated by Matplotlib

Source: Generated by Matplotlib Source: Internet

Source: Internet